Our expert team are delighted to provide professional insight and opinion on all aspects of financial crime. For Press Enquiries please contact us.

December 14, 2023

Financial crime globally costs around $2.1 trillion, surpassing the annual GDP of major economies like G20 nations.

The inaugural ‘Risk 4.0’ Forum was held as part of the Abu Dhabi Finance Week, sponsored by the UAE Executive Office of Anti-Money Laundering and Counter Terrorism Financing.

For the global community engaged in the fight against financial crime, the inclusion of the Risk Forum to examine the financial crime risks during a period known as the ‘fourth industrial revolution’ is not only timely, but of critical importance.

The term ‘fourth industrial revolution’, as coined by the World Economic Forum, refers to the current era of connectivity, advanced analytics, automation, and advanced manufacturing technology.

Financial crime is a global problem, costing the global economy an estimated at $2.1 trillion, equal to or larger than the annual GDP of major economies and countries, including G20 nations.

This staggering number excludes corruption, tax evasion or cybercrime, underlining the significant damage caused by criminals, from drug and human trafficking to environmental and climate change-related crimes.

When we look to the lessons of history, and those previous ‘revolutions’, we see that key moments in time bring about significant change, with some transitions curbed, other initiated, and some accelerated.

Navigating financial crime in the fourth industrial revolution

Today, we face a pivotal question: does the fourth industrial revolution signify an increase in threats from financial crime, or will it facilitate efforts to counter such criminal activity? At stake is the integrity of the global financial system, the health of our economies, and the right of citizens to live free from crimes related to money laundering and the financing of terrorism.

Financial crime is never victimless, it affects us all.

We believe that the future is ours to shape. By coming together, as we did last week at the Risk Forum, we can mitigate the emerging risks brought about by the fourth industrial revolution and create major development and investment opportunities.

The fourth industrial revolution can be characterised by three major transitions: in technology, energy, and world order. All three transitions significantly impact how financial crimes are committed, and how we are combatting them.

Technological innovations transforming financial system

The technology transition, well documented with innovations such as online financial products (such as buy now pay later), the Metaverse and virtual assets, has transformed the financial system. And the scale of our response is considerable: a study by Juniper Research estimates that global software spend on financial crime prevention tools will exceed $28.7 billion by 2027, increasing from $22.1 billion in 2023.

While these technologies offer new opportunities for fraudsters, we are witnessing a proliferation of cybercrimes targeting corporations and individuals. Advanced technologies such as AI, VR, and machine learning, provide advantages to law enforcement and criminals alike. However, the power is in our hands.

Global efforts are having an impact, particularly in cryptocurrencies, with Chainanalysis reporting a 65 percent reduction in crypto inflows to known illicit entities between January and July this year compared to the same period in 2022.

Together with the UAE’s hosting of COP28 this year, it is crucial to note that the financial system continues to be abused to launder money from climate crimes, with the Illegal Wildlife Trade threatening biodiversity to the value of $200 billion annually according to estimates by the World Bank. At COP28, the Executive Office is supporting and taking part in the International Initiative for Law Enforcement of Climate Crimes, led by the UAE Ministry of Interior and United Nations Office on Drugs and Crime.

We must remain vigilant to green transition risks from corruption, fraud, and counterfeit goods.

Addressing challenges from the fourth industrial revolution and its related transitions will require robust international cooperation and effective partnerships with the private sector. It will require renewed commitment, sufficient resourcing, and a prioritised approach to sustainable and continuous AML/CFT systems.

December 13, 2023

On October 17, 2023, Themis, a technology platform that helps its clients manage their financial crime risk exposure, and World Wildlife Fund (WWF) UK, announced that they are working together to produce a Deforestation and Land Conversion-Linked Financial Crimes Toolkit to be launched next year.

As the statement announcing the toolkit explains, deforestation, in particular of tropical forests and ecosystems in the Amazon, the Congo Basin and Southeast Asia, and land conversion, when land is converted from its primary use, such as a forest, savannah or grassland, for agriculture or infrastructure uses, have significant environmental impact globally. Earlier this year, the Grantham Research Institute on Climate Change and the Environment at the London School of Economics estimated that land use change and, in particular, deforestation, may contribute up to 20% of global greenhouse emissions. Forest degradation—in which total forest area remains unchanged but its structure or overall function has been altered—is also problematic. Both deforestation and land conversion can also adversely impact disenfranchised indigenous and local communities more acutely, causing health issues, loss of income, displacement and human rights violations.

As the statement notes, while deforestation and land conversion are often driven by demand for legal, high-value cash crops, including everyday consumables like cocoa, coffee and cattle, as well as resources such as timber, rubber and minerals, the production of these commodities are also susceptible to infiltration by criminal groups. Government corruption, inadequate land protection regulations, or limited regulatory oversight can lead to illegal land conversion, exposing financial institutions in certain regions to the risk of financial crimes related to these commodities. The Toolkit on Deforestation and Land Conversion-Linked Financial Crimes aims to help financial institutions understand and identify these risks, and address and report any transactions that may involve illegal deforestation and land conversion to the authorities.

The Deforestation and Land Conversion Toolkit will be modeled on the Illegal Wildlife Trade (IWT) Toolkit, also produced by Themis and WWF, and will include guidance on a strategic framework and best practices, risk assessment and reporting, as well as general subject matter background. Both toolkits aim to offer a broad view of direct and indirect risks across supply chains.

The first stage of the project is led by UK Finance, a trade association that represents over 300 firms across the UK banking and financial services sector, which is finalizing a research report on deforestation and financial crimes to be shared at COP28 in Dubai. The report will be based on a survey from professionals at financial institutions, in particular, risk and compliance professionals in banks and insurance firms. The finalized deforestation toolkit will be launched at COP29, set to take place in Q3 2024.

Taking the Temperature: While deforestation and land conversion have long been the topic of environmental and social activism, the legal and financial risks associated with directly or indirectly financing or otherwise causing deforestation, whether legal or illegal, are rapidly growing in significance. As we have reported recently, deforestation is increasingly the focus of regulatory, litigation and environmental advocacy attention globally. In June, Brazil announced a package of environmental measures aimed at controlling and eventually halting deforestation by 2030. Outside of this high-risk region and others, regulators are focused on the impact that the industry has on deforestation and environmental degradation. In April, the U.S. Department of Justice formed the Timber Interdiction Membership Board and Enforcement Resource (TIMBER) Working Group to investigate and prosecute the illegal trade of timber around the world and the deforestation that results. And as we covered in June, the European Parliament has adopted amendments to the Corporate Sustainability Due Diligence Regulation requiring large companies operating in the EU to conduct due diligence to identify, prevent, mitigate or end negative impacts on human rights and the environment, including biodiversity loss and environmental degradation. Industry’s role in deforestation has also resulted in litigation. In May, environmental group ClientEarth filed a complaint against Cargill, one of the world’s largest soy and grain traders with the Organization for Economic Cooperation and Development (OECD) over alleged deforestation and related human rights issues in Brazil in violation of the OECD Guidelines for Multinational Enterprises. We also reported earlier this year on a novel arbitration strategy on the part of Azerbaijan, which commenced an action against Armenia under the Bern Convention on the Conservation of European Wildlife and Natural Habitats, the first such interstate arbitration alleging that actions including deforestation have jeopardized more than 500 wildlife species.

Read ArticleHow important is it to manage your financial crime risk for your business?

Meet Themis, standing out as a trailblazer in democratizing Governance, Risk, and Compliance by fostering seamless collaboration, thus setting a new benchmark for industry collaboration!

ما هي أهمية إدارة مخاطر الجرائم المالية لنجاح عملك؟

تعرّف على ثيميس، الشركة الرائدة في تمكين الحوكمة، وإدارة المخاطر، والامتثال، من خلال تعزيز التعاون السلس، ووضع معايير جديدة للتعاون في هذا المجال

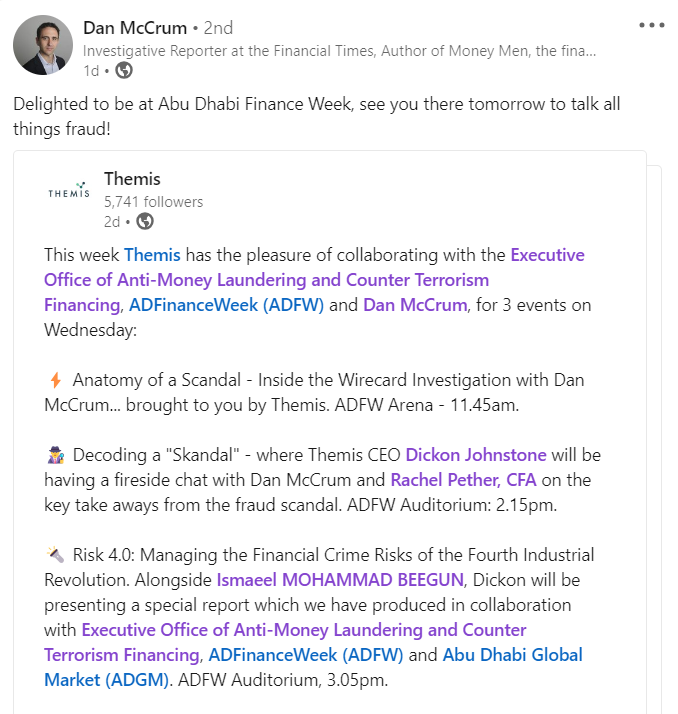

Celebrate Themis' Dynamic Participation at ADFinanceWeek (ADFW) in Abu Dhabi!

This week, Themis had the honour of collaborating with the Executive Office of Anti-Money Laundering and Counter Terrorism Financing at ADFW, creating unforgettable moments captured in these pictures.

Anatomy of a Scandal - Inside the Wirecard Investigation with Dan McCrum, brought to you by Themis at ADFW Arena.

Decoding a "Skandal" - Themis CEO Dickon Johnstone in a fireside chat with Dan McCrum and Rachel Pether, CFA, exploring key takeaways from the fraud scandal at ADFW Auditorium.

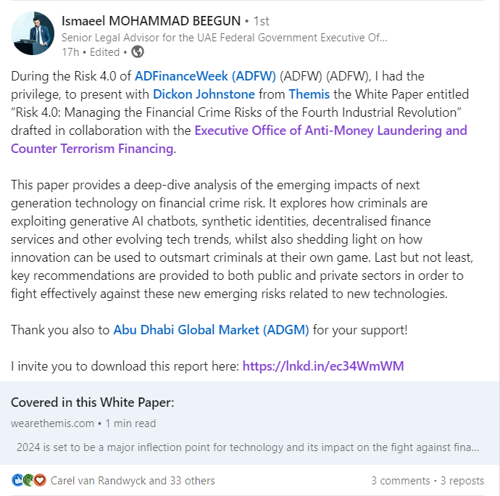

Risk 4.0: Managing Financial Crime Risks of the Fourth Industrial Revolution - Dickon, alongside Ismaeel Mohammad Beegun, presents a special report in collaboration with ADFW and Abu Dhabi Global Market at ADFW Auditorium.

Download the report here

Themis is honoured to be nominated for BEST KYC SOLUTION at the MENA Fintech Awards, hosted by MENA FINTECH ASSOCIATION.

Acknowledged by Ismaeel Mohammad Beegun, Executive Office of Anti-Money Laundering and Counter Terrorism Financing!

Themis is humbled to receive a special mention from Ismaeel Mohammad Beegun on LinkedIn.

Acknowledged by Dan McCrum, Financial Times Reporter!

A heartfelt thank you to Dan McCrum for acknowledging our commitment to excellence.

We express our heartfelt gratitude to Chris Hughes, Mohamed Shalo, EMBA, Ismaeel Mohammad Beegun, Patrick Forbes, Zille Rehman, Tim Land, Hub71, and Nameer Khan for your unwavering support throughout this week.

November 30, 2023

Prominent AI institutions in Abu Dhabi came together to explore the city's early commitment to AI

Expanding on the achievements of the largest Fintech Festival in the Middle East and North Africa (MENA) region, hosted by Abu Dhabi Global Market (ADGM), the 7th edition of Fintech Abu Dhabi attracted a remarkable gathering of global financial technology leaders and visionaries. The event brought together individuals at the forefront of innovation from prominent financial institutions, startups, innovators, entrepreneurs, venture capitalists, scientists, and academics, further establishing Abu Dhabi as a progressive hub for innovation and technology.

Read more: ADFW 2023: Navigating Abu Dhabi’s evolving investment landscape at Asset Abu Dhabi

In partnership with Huawei, ADGM’s flagship event, Fintech Abu Dhabi, once again took center stage during Abu Dhabi Finance Week (ADFW) this year. With its core theme of ‘The Convergence of Finance and Technology’, the event commenced with a dynamic discussion on the financial crime economy, bringing together prominent AI institutions in Abu Dhabi to explore the city’s early commitment to AI. The participants also delved into the evolution of the crypto industry. Dr. Alexander Lipton, global head of Research & Development at ADIA, shared valuable insights on how social media is reshaping the global banking landscape, while the CEO of Circle outlined strategies for leveraging digital assets to enhance global financial stability.

Among the other captivating sessions, Financial Times Investigative Reporter Dan McCrum and Themis Founder and CEO Dickon Johnston shed light on the investigation into Wirecard in a session titled ‘Decoding a “Skandal” – Inside Wirecard’s Investigation’, and VaynerX Chairman and CEO Gary Vaynerchuk explored the entrepreneurial mindset in a session titled ‘Finding an Entrepreneurial Mindset’.

Read ArticleNovember 29, 2023

ABU DHABI, United Arab Emirates, Nov. 29, 2023 /PRNewswire/ — Building upon the successes of MENA’s biggest Fintech Festival presented by Abu Dhabi Global Market (ADGM), the 7th edition of Fintech Abu Dhabi welcomed an impressive turnout of financial tech leaders and visionaries converging from across the globe today. This included those leading innovation in major financial institutions, startups, innovators, entrepreneurs, venture capitalists, scientists and academics, solidifying Abu Dhabi’s position as a forward-thinking innovation and tech hub.

ADGM’s flagship event, Fintech Abu Dhabi, conducted in partnership with Huawei continued to be a highlight of Abu Dhabi Finance Week (ADFW) this year, focusing on the central theme of the event – ‘The Convergence of Finance and Technology’. The event kicked off with a lively debate on the financial crime economy and brought together prominent AI institutions in Abu Dhabi to discuss the city’s early commitment to AI. Participants also delved into the maturity of the crypto industry. Dr. Alexander Lipton, Global Head of Research & Development at ADIA provided insights on how social media is reshaping the global banking landscape, while the CEO of Circle outlined strategies for harnessing digital assets to enhance global financial stability. Other interesting sessions today included ‘Decoding a “Skandal” – Inside Wirecard’s Investigation discussed by Financial Times Investigative Reporter – Dan McCrum and Themis Founder and CEO – Dickon Johnston and ‘Finding an Entrepreneurial Mindset with VaynerX Chairman and CEO – Gary Vaynerchuk.

One-of-a-kind forums featured during Fintech Abu Dhabi included Blockchain, AI and Risk & Security. Blockchain Abu Dhabi presented in partnership with Circle discussed topics such as the quest to design stability for digital money, digital currencies of Central Banks improving digital asset infrastructure and the overall impact of blockchain and Web3 on the financial industry. AI Abu Dhabi was conducted in collaboration with Mastercard while Risk 4.0 was conducted in association with the Executive Council for Anti-Money Laundering and Counter Terrorism Financing.

During the event, ADGM – in collaboration with its partners, unveiled initiatives to redefine regulatory practices. The Financial Services Regulatory Authority (FSRA) outlined its “Regulation as a Service” strategy through its Digital Lab, aimed at co-creating innovative solutions for the licensing and supervision of firms. Noteworthy collaborations of the FSRA with the National University of Singapore announced aims to develop an AI-powered assessment tool for virtual asset service providers seeking licensing in ADGM.

In its efforts for continuous improvement, the FSRA announced soliciting feedback on a discussion paper related to information technology (IT) risk management to enhance firms’ operational resilience. Furthermore, fostering innovation in Decentralised Finance (DeFi), the FSRA unveiled a collaboration with Coinbase Asset Management and Neoply and also nudged towards a DeFi consultation paper slated for publication in 2024, alongside enhancements to the existing regulatory framework.

Linda Fitz-Alan Registrar and Chief Executive at ADGM Courtssaid, “In its staggering 7th edition, Fintech Abu Dhabi started as a pioneer, awakening our imagination, guiding the disruption of our norms and making innovation our constant. This is no longer an annual event; this is a pivotal marker to test the temperature and tap into the thoughts of global leaders in financial technology. The insightful discussions at Fintech Abu Dhabi do not just shape the future of the fintech landscape, but also create its landscape while opening our minds to the endless possibilities for the future of the financial sector.”

Furthermore, major announcements by global companies such as GQG Partners (GQG) an independent asset management firm with more than USD 100 billion in AUM and Offset8, a proprietary asset management firm specialising in the global verified carbon credits (VCC) market announced receiving an In-Principle Approval (IPA) from the Financial Services Regulatory Authority (FSRA) of the ADGM. IOTA, the open public goods infrastructure ushering in digital asset innovation, announced its registration as the first company to be registered under the DLT Foundations Regulations of ADGM.

MEVCA and New York and Singapore headquartered-GPCA announced a partnership that will see GPCA establish a permanent presence in the Middle East, with the support of MEVCA.

The Global Financial Regulators Summit, a closed-door gathering of key global financial regulatory leaders was conducted parallel to Fintech Abu Dhabi and discussed the role regulators play in shaping the sustainable finance landscape of the future. The outcomes of the summit will be announced tomorrow during the R.A.C.E (Regulation, Awareness, Collaboration & Ecosystem) Sustainability Summit.

Read ArticleABU DHABI, 24th November, 2023 (WAM) -- In partnership with the UAE’s Executive Office of Anti-Money Laundering and Counter Terrorism Financing (EO AML/CTF) and Abu Dhabi Global Market (ADGM), Themis, an ADGM-, DIFC- and UK-registered business utilises innovation and intelligence to reduce the global impacts of financial crime, announced the publication of a seminal new research report to coincide with this year’s Abu Dhabi Finance Week (ADFW).

This report, entitled ‘Risk 4.0: Managing the Financial Crime Risks of the Fourth Industrial Revolution’, provides a deep-dive analysis of the emerging impacts of next-generation technology on financial crime risk. It explores how criminals are exploiting generative AI chatbots, synthetic identities, decentralised finance services and other evolving tech trends, whilst also shedding light on how innovation can be used to outsmart criminals at their own game.

The report will be presented during the Risk 4.0 session of ADFW on 29th November by representatives from Themis and the EO AML/CTF. A collaboration between Themis, the EO AML/CTF and ADFW, it provides a range of recommendations to help both public and private sector stakeholders deploy next-generation technologies for good, whilst mitigating associated risks. In this way, the research feeds into strategic anti-financial crime work being undertaken across the MENA region and beyond.

“As the pace and complexity of the financial system continues to increase, the effectiveness of global financial crime efforts will be contingent on the readiness of governments and the private sector to innovate in a strategic and coordinated manner. The UAE has embraced a technologically advanced future across all parts of the national AML/CFT system in order to mitigate financial crime risks associated with new technologies. The publication of this important White Paper at Abu Dhabi Finance Week 2023 is an exemplary example of information sharing that will bring ADFW participants and industry professionals more widely up to date with the latest developments,” said Mohamed Shalo, Director of Communications and Strategic Partnerships at the EO AML/CTF.

“2024 is set to be a major inflection point for technology and its impact on the fight against financial crime globally. Criminals are constantly leveraging innovation to conduct their illicit activities in new ways that are harder to spot. At the same time though, we’ve seen first-hand at Themis the tremendously positive role that technology can play in anti-financial crime efforts. It allows us to connect dots in new ways, helping expose hidden connections and links to illicit activity, and providing us with the tools to stop criminals in their tracks. There is no better opportunity to foster innovation in this area than at ADFW, which brings together industry leaders from across the world on this very topic," said Dickon Johnstone, CEO of Themis.

Themis is an ADGM-, DIFC- and UK-registered business that aims to reduce the global impacts of financial crime through a powerful combination of innovation, insight and intelligence. Its award-winning anti-money laundering software, Themis Search Monitoring, helps organisations understand financial crime threats through an ESG and socio-economic lens, so that they can better protect their customers, staff, suppliers and shareholders from criminal attacks or association.

Themis also conducts proprietary threat-based research and investigations to highlight the latest financial crime threats, trends, and techniques. Themis has worked with governments, regulators and law enforcement bodies around the world to understand the global flow of illicit finance. Notable examples include multi-year studies on the illegal trafficking of wildlife as well as people, gold and other commodities. In recognition of Themis’ purpose-driven and ESG approach to addressing the global challenges of financial crime, the company was awarded full B-Corp status in 2022.

Read Articleتوفر مجموعة الأدوات مورداً قيماً للمؤسسات المالية وتساعدها في مواجهة المعاملات المشبوهة المتعلقة بالاتجار غير المشروع بالأحياء البرية والإبلاغ عنها

The Toolkit provides a valuable resource for financial institutions to help them address and report suspicious transactions relating to IWT.

ABU DHABI, 24th November, 2023 (WAM) -- The Executive Office of Anti-Money Laundering and Counter Terrorism Financing (EO AML/CTF) has announced its theme sponsorship for the Abu Dhabi Finance Week (ADFW) ‘Risk 4.0’ programme. The event takes place on 29th November at Abu Dhabi Global Market (ADGM).

Abu Dhabi Finance Week is held this year under the patronage of H.H. Sheikh Khaled bin Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi, and Chairman of the Executive Council. It is widely acknowledged to be the most influential finance, investment, and economic event in the MENA region.

This year’s edition builds on the success of its inaugural event in 2022, which saw participation from over 8,000 individuals representing more than 100 countries.

The Risk 4.0 programme has been introduced to the 2023 ADFW agenda to focus on the increased financial integrity risks such as money laundering, fraud, corruption, technological vulnerabilities, and regulatory scrutiny. It will be held mostly in the ADGM Auditorium, with several sessions featured on the main stage.

The agenda will cover some of the most debated issues in anti-money laundering and counter-terrorism financing today.

Panel sessions will feature leading figures from international organisations on the frontline in the fight against financial crime alongside leaders from across the private and governmental sectors.

Hamid AlZaabi, Director-General of the EO AML/CTF, welcomed the sponsorship of the Risk 4.0 programme, and said the platform makes an important contribution to the global debate of the biggest financial integrity risks facing corporates and governments today.

He explained, “It gives me great pleasure to announce the EO AML/CTF sponsorship of ADFW Risk 4.0. This year’s theme of ‘Investing in the transition era’ shines a light on the emerging risks posed not only to governments and corporates, but also to the integrity of the global financial system.

ADFW participants will hear from some of the leading figures in industries on the front line in the effort to combat money laundering, fraud, corruption and other crimes that cause damage to our economies and societies. I am particularly pleased that the agenda features experts who have been involved in the UAE’s fight against financial crime, and who will share our experience with partners and stakeholders from around the world.”

Commenting on EO AML/CTF’s sponsorship at Risk 4.0, Emmanuel Givanakis, CEO of the Financial Services Regulatory Authority (FSRA) of ADGM) said, “We welcome the Executive Office of Anti-Money Laundering and Counter Terrorism Financing as theme partners of Risk 4.0. Financial integrity is important to promote sound practices in any financial centre.

The measures to prevent financial crime, money laundering and fraud are key to economic growth and stability. ADGM's commitment to addressing AML and CTF risks aligns with our role as a responsible International Financial Centre and reinforces its dedication to align with international standards and the global financial community. Through ADFW’s strategic platform, we aim to highlight several topics that address and confer issues and solutions.”

Risk 4.0 will open with a keynote by Hamid AlZaabi on recent developments in the world of financial crimes and the initiatives undertaken by UAE to combat money laundering activities. The agenda includes four panel sessions with thought leaders in their respective fields, in addition to special presentations and fireside chats with Rachel Pether of Fintech TV at Emcee.

Celebrated investigative journalist Dan McCrum will share key takeaways from the Wirecard scandal and draw on his personal experiences to offer analysis on the world of financial fraud.

The EO AML/CTF, ADFW and financial crime consultancy Themis will publish a collaborative whitepaper online assessing the financial crime risk outlook for 2023, and the initiatives taken to mitigate the most concerning issues. The white paper will be presented as part of the agenda by Dickon Johnstone, Founder and CEO of Themis.

Read ArticleRachel Pether and Dickon Johnstone, Founder and CEO of Themis discuss how the company is aiding in the fight against digital financial crime and environmental crime. They also have a chat on the links between environmental and financial crime and how businesses can build long-term sustainable ventures.

Read ArticleBehind much of the environmental destruction and climate change that the ESG agenda seeks to combat lies a highly profitable underground economy that the Financial Action Task Force (FATF) estimates is worth $110 bn – 281 bn every year. Yet financial crime related to environmental and social issues is under-reported and its significance underestimated.

Arab Banker asked Elizabeth Humphrey, a financial crime researcher at Themis, a specialist anti-financial crime platform, to explain the connection between environmental damage, climate change, and financial crime.

Read ArticleSmall-scale gold producers in East Africa are dependent on informal or criminal pre-financing structures, with illicit gold likely ending up in international trading markets, researchers warn.

Read ArticleTreasury Investigates Banks Over Closure of Accounts Based on Political Views: A recent investigation by the Treasury reveals that several banks are being probed for closing accounts due to their customers' political beliefs.

Banks are legally obligated to screen high-risk clients against sanctions lists and Politically Exposed Persons (PEP) databases to prevent corruption and financial crime. However, concerns arise when banks apply these strict measures to low-risk customers or use them to scan for unfavourable political opinions.

The process, known as 'adverse media' screening, involves searching for adverse terms associated with the customer's name, leading to automated alerts. The issue gains attention as prominent figures like Nigel Farage claim that banks refused their custom based on subjective interpretations of adverse media.

While adverse media searches are crucial for detecting financial crime, using them to assess customers' political alignment poses challenges and potential consequences for the banking industry.

Read Article

We are delighted to announce that Themis has been named a 2022 Best for the World™ B Corp™ in recognition of exceptional positive impact on its Governance.

Best for the World is a distinction granted by B Lab to Certified B Corporations (B Corps) whose verified B Impact Scores in the five impact areas evaluated in the B Impact Assessment — community, customers, environment, governance, and workers — rank in the top 5% of all B Corps in their corresponding size group.

Dr Roger Koranteng, adviser and Head, Public Sector Governance, at the Commonwealth Secretariat received the International Anti-Corruption Excellence Award at the Themis Awards.

The Themis Anti Financial Crime Awards recognise those who are going above and beyond on their work combatting financial crime across the world.

Dr Koranteng was recognised for his work spanning over 27 years where he has promoted and championed anti-corruption and financial crime work in the Commonwealth member countries as well as non-Commonwealth member states.

Read ArticleThemis offers an innovative approach that helps clients identify and protect against financial crime risks. The company’s award-winning technology platform Themis Search & Monitoring enables seamless due diligence, allowing clients to search for any individual or company anywhere in the world to see if they have potential links to criminality.

Read ArticleDr Roger Koranteng, adviser and Head, Public Sector Governance, at the Commonwealth Secretariat received the International Anti-Corruption Excellence Award at the Themis Awards.

The Themis Anti Financial Crime Awards recognise those who are going above and beyond on their work combatting financial crime across the world.

Dr Koranteng was recognised for his work spanning over 27 years where he has promoted and championed anti-corruption and financial crime work in the Commonwealth member countries as well as non-Commonwealth member states.

UK-based financial crime platform Themis has raised £3.1 million in a Pre-Series A funding round and has reached a valuation of GBP 15.4 million.

The company plans to use the funds to improve and further develop its automated due diligence platform, Themis Search and Monitoring, which was launched in 2020. This product allows users to screen their clients, suppliers, and investors against sanctions watchlists, PEPs, litigation, adverse media, criminal convictions and corporate registries. It also offers 24-hour ongoing monitoring of legal entities and individuals.

Themis uses artificial intelligence and machine learning to detect potential links to financial crime.

Founded in 2018, Themis reported a 57% growth in revenues in 2022 compared to the previous year.

After the latest round of funding, the UK-based company is now valued at £15.4m. It comes on the back of a £1.67m seed round in 2021.

Read ArticleDigital financial crime platform Themis has successfully overfunded in its latest Pre-Series A funding round, raising a total of £3.1m.

This comes on the back of a successful seed round of £1.67m in 2021. The company is currently valued at £15.4m and is forecasting a robust growth “as governments and regulators around the world crack down on AML failings and more and more companies recognise the importance of conducting comprehensive due diligence on their clients, suppliers and third parties.”

Read ArticleBREAKING MARKET & INDUSTRY NEWS

Themis announced a $3.8M pre-Series A round.

Congratulations to Dickon Johnstone and team.

Read ArticleThemis, provider of a digital financial crime platform, has secured £3.1 million in its latest Pre-Series A funding. The London-based company raised £1.7 million in a seed round in 2021, and will use the funds to continue development of its automated due diligence platform, Themis Search and Monitoring, that was released in 2020.

Read ArticleDigital financial crime platform Themis has successfully overfunded in its latest pre-Series A funding round, raising a total of £3.1million. The company is currently valued at £15.4million and is forecasting a robust growth.

Read ArticleDigital financial crime platform Themis has successfully overfunded in its latest Pre-Series A funding round, raising a total of £3.1m.

This comes on the back of a successful seed round of £1.67m in 2021. The company is currently valued at £15.4m and is forecasting a robust growth “as governments and regulators around the world crack down on AML failings and more and more companies recognise the importance of conducting comprehensive due diligence on their clients, suppliers and third parties.”

Themis reported a 57% growth in revenues in 2022 from the previous year.

Read ArticleThemis, a digital financial crime platform, has scored £3.1m in its latest pre-Series A funding round.

Themis is currently valued at £15.4m and reported a 57% growth in revenues in 2022 from the previous year.

Themis uses advanced AI and ML technology, powered by threat-based data, research and intelligence to detect potential links to financial crime.

Read ArticleAward-winning digital financial crime platform Themis announces today that it has successfully overfunded in its latest Pre-Series A funding round, raising a total of £3.1m.

This comes on the back of a successful seed round of £1.67m in 2021. The company is currently valued at £15.4m and is forecasting a robust growth as governments and regulators around the world crack down on AML failings and more and more companies recognise the importance of conducting comprehensive due diligence on their clients, suppliers and third parties. Themis reported a 57% growth in revenues in 2022 from the previous year.

Read ArticleABA Corporate Member, Themis, has produced a useful briefing note on Trust and Company Service Providers (TCSPs) in the MENA region and how TCSPs can be used for illicit purposes.

Themis says that the MENA region faces significant financial crime risks related to the absue of TCSPs. This is partly due to many countries in the region having under-regulated TCSPs, but also to many countries having gaps in regulations related to beneficial ownership transparency.

Read ArticleA brief overview of increasing serious organised criminal involvement with modern slavery and human trafficking.

Read ArticleOur CFO, James Wightman, participates in a discussion with Brandy Scott & Richard Dean at Dubai Eye 103.8 radio show relating to the recent FTX scandal as well as how our AI due diligence technology platform is changing the way companies perform due diligence.

Full video available through the link below (Fast forward to 53 minutes on the show)

Check out Dubai Eye On One.

Day Two at ADFinanceWeek (ADFW) is officially in the books!

Today we had the chance to hear from numerous leading experts in the tech field while some of our startups discussed the latest updates in the Crypto World and the digital currency markets. They also explored why startups thrive in the MENA region, how to empower talented and skilled women in tech and what solutions are enabled by the revolutionary innovation of HealthTech.

Read ArticleStart-up Campus at Capital Square is an ambitious, entrepreneurial platform coming to you from 15 to 17 November.

ADFW's Start-up Campus will gather and exhibit 100+ start-ups, serving as the optimal platform for new solutions, enterprising investors, broader horizons and budding talents. In partnership with Hub71, the Start-up Campus is one of the many social networking events at Capital Square, open to all ADFW attendees.

Read Articleمقتطفات من اليوم الثاني لمشاركة #سوق_أبوظبي_للأوراق_المالية كشريك رسمي في #اسبوع_أبوظبي_المالي

Highlights from Day 2 of ADX's participation as an official partner during #AbuDhabiFinanceWeek.

The event took place on Tuesday 27th September in London to a crowd of over 400 delegates and included a keynote speech from Lord Chris Patten, two panel sessions featuring UK-based private wealth specialists, and an endnote fireside chat with retail expert Mary Portas.

Read ArticleBe honest. Do you consider ESG (environmental, social and corporate governance) indicators and AML (anti-money laundering) compliance slightly tiresome but necessary processes to avoid regulatory fines or the reputational risk of being labelled non-compliant? Of course, these are important considerations for the health of a business, and it is crucial to satisfy regulatory requirements. But it’s also so, so important to remember the underlying reason why such regulations have been put in place. They are there to tackle the enduring, devastating impacts that illicit activity can have on the planet and its people—on the macro-ecosystem rather than just the micro-ecosystem of your company.

Read ArticleGTInterviews is a series of conversations with our community of industry experts - from our network partners and clients through to our own team. We discuss what brings people to the world of due diligence and investigations and how they see the industry changing in the coming years. This month we chatted with Henry Williams, Head of Investigations at Themis.

Read ArticleBanks in South Africa are likely to face difficulties, as well as higher costs, doing cross-border business and attracting foreign investment should the country fail to meet international anti-money laundering benchmarks.

Read ArticleBanks caught up in money laundering scandals suffer an average 21% slump in their share price, researchers say, as warnings grow over regulatory scrutiny of the trade finance sector.

Read ArticleThemis has been certified by B Lab, the not-for-profit behind the B Corp movement, as having met rigorous social and environmental standards which represent its commitment to goals outside of shareholder profit.

Read ArticleThe ongoing Russian invasion of Ukraine has led to an unprecedented international response, including the sanctioning of Russian entities and individuals in a bid to weaken the Putin regime. The speed, scope, and complexity of these sanctions pose a significant challenge to businesses and organisations as they attempt to successfully navigate compliance obligations.

Read ArticleESG Investor’s weekly round-up of news on technology and tools in the sustainable investing sector, including Impact Cubed, NatureAlpha, Sylvera, Carbon Trust, Themis, Manifest Climate and AirCarbon Exchange.

Read ArticleThe UK Independent Anti-Slavery Commissioner, Dame Sara Thornton, the UK National Modern Slavery Training Delivery Group, and Themis, with further support from other companies, have launched an anti-slavery digital learning service for financial actors across 10 of the industry’s sub sectors including retail banking, corporate banking, investment, insurance, accountancy, and crypto. It is accredited by the London Institute of Banking and Finance.

Read ArticleA ground-breaking new anti-slavery digital learning for the financial services industry has been launched this week. This free to use training is available to all and provides interactive, engaging guidance for financial actors across ten industry sub sectors including retail banking, corporate banking, investment, insurance, accountancy, and crypto.

This training has been developed in partnership with the IASC, the UK National Modern Slavery Training Delivery Group, and Themis, with support from Unseen, RedCompass Labs and AllianceBernstein. It is accredited by the London Institute of Banking and Finance.

Read ArticleThe free to use training provides guidance for financial actors across ten industry sub sectors including retail and corporate banking, investment, insurance, and accountancy.

This training has been developed in partnership with the UK Independent Anti-Slavery Commissioner, Dame Sara Thornton, the UK National Modern Slavery Training Delivery Group, and Themis, with support from Unseen, RedCompass Labs and AllianceBernstein. It is accredited by the London Institute of Banking and Finance.

Read ArticleModern slavery is estimated to generate over $150 billion in profits annually and is one of the top three international crimes alongside drug trafficking and trade in counterfeit goods.

There are well over 40 million people in slavery around the world, while an estimated 130,000 people are exploited in the UK through forced labour, criminal exploitation and other forms of slavery. The recent economic hardship resulting from Covid-19 restrictions is likely to increase vulnerability to exploitation, and conflict - including the war in Ukraine - is generating hundreds of thousands of potential victims of trafficking and exploitation. It is more important than ever that businesses consider the ways in which they might unwittingly be linked to modern slavery.

Read ArticleThe toolkit will help law enforcement and financial institutions such as banks and mobile money service providers to detect and share information with other countries in an effort to address suspicious transactions relating to trafficking in wildlife.

Read ArticleThe hybrid work environment looks like it’s here to stay, and it continues to be a breeding ground for a dramatic increase in insider fraud. That’s one of the key takeaways from the joint Themis-Bottomline survey report, “Insider Fraud in Banks: The Post-COVID Threat Landscape,” which found that 75 percent of banks perceived an increase in insider fraud risks since the start of the pandemic. The issue is compounded by the finding that 50 percent of survey respondents identified insufficient technology tools as a major obstacle to detecting fraud and collusion.

Read ArticleThe government of the UAE has worked with the UK government to launch a toolkit to support financial institutions in tackling illicit financial flows in Illegal Wildlife Trade (IWT).

Read ArticleTourism and Wildlife CS Najib Balala hosted United Kingdom's minister for the Pacific Int'l Environment, Climate and Animal welfare, Lord Zac Goldsmith at Nairobi National Park to celebrate World Wildlife Day.

Read ArticleFinancial institutions worldwide are urged to adopt the toolkit; share it with colleagues, peers and industry partners; and take action to stamp out IWT. The UK and UAE governments have jointly launched a new, freely accessible toolkit to support financial institutions in tackling illicit money flows associated with IWT (illegal wildlife trade).

Read ArticleUK and UAE governments launch new toolkit to support financial institutions in tackling illicit money flows associated with illegal wildlife trade at Expo Dubai on 3rd March to coincide with UN World Wildlife Day.

Read ArticleIt has been two years since Covid-19 struck and today, certain aspects of the pandemic-defined world are emerging as a daily reality that will remain in place even after restrictions are lifted, presenting a new normality of sorts.

Read ArticleThe coronavirus took over the world over two years ago, yet there are specific features of the world which have been implemented, as a consequence, these features are have been established as an everyday occurrence that is going to last even after the current limitations ease, thus, creating a revamped norm.

Read ArticleThe UAE AML/CFT Public Private Partnership Committee (PPPC) concluded its fourth meeting, which included presentations from the Federal Customs Authority and SOCNet, a division within the UK’s Foreign, Commonwealth and Development Office and Home Office, which aims to develop international partnerships to tackle serious and organised crime.

Read ArticleThis week’s Roundtable on Trafficking in Human Beings and the Financial Sector, jointly organized by the OSCE, IASC and the FAST, brought together financial institutions, financial intelligence units, and anti-trafficking coordinators from twelve countries to discuss the importance of detecting and disrupting illicit financial flows generated from trafficking in human beings within legitimate financial networks.

Read ArticleThe MENA Financial Crime Compliance Group (MENA FCCG) has created a European Chapter to lead and coordinate the efforts of Middle East banks to fight financial crime in Europe.

Read Article

Abu Dhabi: In partnership with the UAE’s Executive Office of Anti-Money Laundering and Counter Terrorism Financing (EO AMLCTF) and Abu Dhabi Global Market (ADGM), Themis is pleased to announce the publication of a seminal new research report to coincide with this year’s Abu Dhabi Finance Week (ADFW).

This report, entitled ‘Risk 4.0: Managing the Financial Crime Risks of the Fourth Industrial Revolution’, provides a deep-dive analysis of the emerging impacts of next generation technology on financial crime risk. It explores how criminals are exploiting generative AI chatbots, synthetic identities, decentralised finance services and other evolving tech trends, whilst also shedding light on how innovation can be used to outsmart criminals at their own game.

The report will be presented during the Risk 4.0 session of ADFW on 29 November by representatives from Themis and the EO AMLCTF. A collaboration between Themis, the EO AMLCTF and ADFW, it provides a range of recommendations to help both public and private sector stakeholders deploy next generation technologies for good, whilst mitigating associated risks. In this way, the research feeds into strategic anti-financial crime work being undertaken across the MENA region and beyond.

“As the pace and complexity of the financial system continues to increase, the effectiveness of global financial crime efforts will be contingent on the readiness of governments and the private sector to innovate in a strategic and coordinated manner. The UAE has embraced a technologically-advanced future across all parts of the national AML/CFT system in order to mitigate financial crimes risks associated with new technologies. The publication of this important White Paper at Abu Dhabi Finance Week 2023 is an exemplary example of information sharing that will bring ADFW participants and industry professionals more widely up to date with the latest developments”, said Mohamed Shalo, Director of Communications and Strategic Partnerships at the EO AMLCTF.

“2024 is set to be a major inflection point for technology and its impact on the fight against financial crime globally. Criminals are constantly leveraging innovation to conduct their illicit activities in new ways that are harder to spot. At the same time though, we’ve seen first-hand at Themis the tremendously positive role that technology can play anti-financial crime efforts. It allows us to connect dots in new ways, helping expose hidden connections and links to illicit activity, and providing us with the tools to stop criminals in their tracks. There is no better opportunity to foster innovation in this area than at ADFW, which brings together industry leaders from across the world on this very topic”, said Dickon Johnstone, CEO of Themis.

About Themis

Themis is an ADGM, DIFC and UK registered business that aims to reduce the global impacts of financial crime through a powerful combination of Innovation, Insight and Intelligence. Its award-winning anti-money laundering software, Themis Search & Monitoring, helps organisations understand financial crime threats through an ESG and socio-economic lens, so that they can better protect their customers, staff, suppliers and shareholders from criminal attacks or association. Themis believes technology and innovation can fundamentally change the way society approaches financial crime and aims to normalise due diligence through tech so that screening for financial crime risks becomes a habitual part of everyday life.

Themis also conducts proprietary threat-based research and investigations to highlight the latest financial crime threats, trends, and techniques. Themis has worked with governments, regulators and law enforcement bodies around the world to understand the global flow of illicit finance. Notable examples include multi-year studies on the illegal trafficking of wildlife as well as people, gold and other commodities. In recognition of Themis’ purpose-driven and ESG approach to addressing the global challenges of financial crime, the company was awarded full B-Corp status in 2022.

For more information about the research or to set up a meeting with Themis during ADFW, please contact: Nadia O’Shaughnessy, Head of Insight, Themis ([email protected]) or Sandeep Sroa, Head of Business Development & MLRO, Themis MENA ([email protected]).

Financial crime has cost businesses over £1million in a year said nearly a third of respondents in a recent white paper published by Themis and Encompass Corporation. The Know Your Customer (KYC) and Anti-Money Laundering (AML) software provider’s white paper titled ‘Financial Crime Compliance: The Cost of Getting it Wrong’ delved into the price that was paid for not adhering to financial crime compliance and where the biggest losses were found.

Read ArticleThe role of the financial sector in eradicating modern slavery: CEOs respond to the Independent Anti-Slavery Commissioner following the launch of a Themis report released earlier this year.

Read ArticleIn an article written for the newly released Autumn 2021 edition of the Arab Banker Magazine, Themis describe how regulatory tolerance for bad compliance has been changing, and what bank managers should be doing to ensure that they – and the banks they manage – meet increasingly stringent expectations of regulators and society as a whole. See Page 58.

View MagazineFinancial crime and regulatory scrutiny to grow across the industry. Along with financial crime specialist Themis, Fiserv published the paper ‘Financial crime risks in investment management’ earlier this year. Co-author of the paper Andrew Davies, Vice President of Global Market Strategy, Fiserv, speaks to Wealth Adviser on the current risks threatening firms and the challenges and opportunities that investment managers face in terms of financial crime compliance.

Read ArticleManagers must count the true costs of financial crime, says Themis Insight. What’s the true cost of financial crime? That’s the question addressed by consulting firm Themis Insight in a new briefing note on how to tackle the problems of crime in the finance sector, and financial crimes in all types of business.

Read ArticleAugust Big Read: The Dark Side Of The Dark Web. Sometimes explainers are necessary to describe terms that crop up but which few may fully understand. One is "the dark web." Financial crimes consultancy Themis takes a deep dive into the covert marketplace, following the influence of cryptocurrencies and how crime is being tackled there.

Read ArticleChannelEye, 5th October 2022. View here

International Banker, 6th September 2022. View here

Ground Truth, 2nd September 2022. View here

S&P Global, August 31st 2022. View here

Global Trade Review, August 31st 2022. View here

Royal Society of Arts, May 16th 2022. View here

UKFinance, May 6th 2022. View here

NEDonBoard, May 4th 2022. View here

ESG Investor, April 1st 2022. View here

The FinTech Times, March 31st 2022. View here

IASC, March 30th 2022. View here

Botswana Gazette, March 29th 2022. View here

Financial Reporter, March 29th 2022. View here

UK Finance, March 29th 2022. View here

Bottomline, March 10th 2022. View here

The East African, March 8th 2022. View here

Middle East 24, March 7th 2022. View here

Focus, March 7th 2022. View here

Al Maghribi, March 7th 2022. View here

Gulf News, March 7th 2022. View here

Khaleej Report, March 7th 2022. View here

Emirati News, March 7th 2022. View here

African Business, March 7th 2022. View here

NNN, March 7th 2022. View here

Khaleej Times, March 7th 2022. View here

Emirates WAM (Arabic), March 7th 2022. View here

Emirates WAM (Russian), March 7th 2022. View here

Emirates WAM (French), March 7th 2022. View here

Emirates WAM (Spanish), March 7th 2022. View here

Emirates WAM (Turkish), March 7th 2022. View here

Emirates WAM (Portuguese), March 7th 2022. View here

Emirates WAM (Chinese), March 7th 2022. View here

Emirates WAM, March 7th 2022. View here

The Star, March 6th 2022. View here

Saturday Nation, March 5th 2022. View here

Daillytrader, March 4th 2022. View here

Global Trade Review, March 3rd 2022. View here

Nation, March 4th, 2022. View here

WealthAdviser, March 4th 2022. View here

The Star, March 4th 2022. View here

Regulation Asia, March 4th 2022. View here

TRAFFIC, March 3rd 2022. View here

The National News, February 20th 2022. View here

MENAFN, February 20th 2022. View here

Zawya, February 9th 2022. View here

Rapidtelecast, February 9th 2022. View here

Global Circulate, February 9th 2022. View here

Emirates WAM, February 9th 2022. View here

OSCE, December 2nd 2021. View here

MENA FCCG, November 30th 2021. View here.

Podcast Addict, November 25th 2021. View here

The FinTech Times, November 24th 2021. View here.

FinTech & Finance News, November 22nd 2021. View here.

LondonLovesBusiness, November 22nd 2021. View here.

Mortgage Introducer, November 22nd 2021. View here.

TransformFinance, November 2021. View here.

Arab Banker, Autumn 2021. View here.

The Conversation, August 25th 2021. View here.

WealthBriefing, August 16th 2021. View here.

WealthAdviser, August 13th 2021. View here

Dow Jones, July 2021. View here.

TCAE, June 28th 2021. View here.

FN, Financial News, June 15th 2021. View here.

Private Equity News, June 15th 2021. View here.

Disruption Banking, May 7th 2021. View here.

RSA, April 1st 2021. View here.

Financial IT, March 27th 2021. View here.

Police Professional, March 26th 2021. View here.

Independent Anti-Slavery Commission, March 24th 2021. View here.

FinTech Innovation Network, March 22nd 2021. View here

ESG Clarity, February 19th 2021. View here.

CityAM, February 12th 2021. View here.

Dentons, February 4th 2021. View here.

Latham & Watkins, February 3rd 2021. View here.

Baker McKenzie, January 22nd 2021. View here.

Humber Modern Slavery Partnership, January 22nd 2021. View here

Ropes & Gray LLP, January 21th 2021. View here.

Institutional Asset Manager, January 19th 2021. View here.

IEMA, January 19th 2021. View here.

Tribe Freedom Foundation, January 19th 2021. View here

The FinTech Times, January 19th 2021. View here.

Supply Management, January 18th 2021. View here.

Emerging Risks, January 18th 2021. View here.

Scottish Financial News, January 18th 2021. View here.

DiversityQ.com, January 18th 2021. View here.

IFA Magazine, January 18th 2021. View here.

Thomson Reuters Foundation January 18th 2021. View here.

ResponsibleInvestor, January 18th 2021. View here.

TheActuary, January 18th 2021. View here.

TransformFinance, January 18th 2021. View here.

Safeguarding And Child Protection Association (SACPA), January 18th 2021. View here.

UK Annual Report on Modern Slavery, October 2020. View here.

Tribe Freedom Foundation, June 16th 2020. View here.